On the mandatory use of accounting programs. Principles of accounting Let's remember about savings

When starting a small business, every entrepreneur must take care of maintaining accounting records. Many argue that there is no need for a private entrepreneur to maintain financial documents, so they miss this point. This issue must be addressed at the stage of creating a private enterprise. Let's look at why it is necessary to prepare financial documents and how to properly conduct accounting for an individual entrepreneur.

The question of maintaining accounting records arises when choosing a taxation system. A competent approach at this stage allows you to select the minimum tax burden taking into account the scope of the company’s activities. Initially, you need to understand the types of taxation so that you don’t accidentally find yourself outside the law with your business. A correctly selected regime allows you to take advantage of tax benefits. In situations where you cannot figure out on your own how to conduct accounting for individual entrepreneurs, which system is better, you can turn to a third-party accountant for help.

An individual entrepreneur is required to report taxes within the deadlines established by law. Failure to comply with deadlines for filing documents due to ignorance does not relieve the defendant from administrative penalties. The deadlines for the transition to the chosen taxation system after registering a company and receiving a certificate are established by law. This period is only 30 days. If the owner of the enterprise has not decided on the choice, OSNO will be assigned by default. In most situations, such a tax burden is not suitable for beginning entrepreneurs.

Features of independent self-employment

According to Law No. 402, an individual entrepreneur is not required to create financial documentation, but this does not give the right to refuse taxes. Tax accounting refers to the collection of information and its synthesis to calculate the tax base and mandatory payments. There are several types of financial documentation: cash and bank statements, primary documentation, information about employees and others.

1C support LINK will help you collect all financial processes into a single database, which will also simplify accounting. You can entrust the formation of the database to a full-time employee or hire a specialist from an outsourcing company. Despite the fact that it is not necessary to maintain accounting documentation, creating a document flow for running your own business is necessary from a practicality point of view.

It is recommended to first calculate your planned income and expenses. The resulting value will help you choose the tax burden. The owner of an individual entrepreneur needs to choose the optimal type of taxation. There is a main OSNO mode and 4 specialized subtypes. The amount of taxes for each of them, depending on the business processes of the enterprise, can vary significantly. It is much easier to keep accounting records in the simplified mode.

Each regime has its own tax reporting. It is necessary to study sample documents for the selected type; they are available on the official website of the Federal Tax Service. It should be decided how many workers will be hired to perform production tasks, if necessary. Regarding personnel, several types of reports are submitted to the Federal Tax Service, the Pension Fund of the Russian Federation and the tax inspectorate. Personnel documents are stored at the enterprise for a certain time in accordance with the law. To independently understand how individual entrepreneurs conduct accounting, it is recommended to use the 1C: Accounting platform or the 1C: Entrepreneur online service. But with many financial transactions and large turnover, it is better to entrust accounting to a specialist.

Accounting on OSNO

It is appropriate to conduct taxes on OSNO only in situations where it is impossible to switch to a simplified procedure. An entrepreneur must submit the following types of reporting:

- 3-NDFL and 4-NDFL;

- VAT return;

- HR report.

IMPORTANT! It should be remembered that these types of reports must be submitted at different times, so it is necessary to study the filing schedule. Failure to meet deadlines is fraught with penalties and unpleasant surprises, including account blocking.

This type of taxation requires mandatory tax reporting in accordance with the norms of the Tax Code of the Russian Federation. All facts relating to business activities must be reflected in handwritten or electronic format, but with a large number of transactions, it is quite difficult to maintain nomenclature records. The information in the book is displayed for each item of goods, and it is necessary to track the dates of receipt and sale, including advance payments, in order to correctly post the amounts of income and expenses.

Features of maintaining documents on the simplified tax system

Under the simplified system, one declaration is submitted annually with the payment of annual tax without advance payments. This regime involves taking into account only income, and the tax rate will be 6%. Advance payments are made quarterly. These will be taken into account when calculating annual payments.

In the Income minus expenses mode, reporting is more difficult due to the need to submit documents on actual expenses. In order for the tax office to recognize the costs, they must be documented correctly. Costs must be economically justified; they must be on the list specified in Article 346.16 of the Tax Code of the Russian Federation.

Accounting in 1C

The best platform for conducting individual entrepreneur activities is considered to be 1C:Entrepreneur. It allows you to generate the entire package of documentation through an online service using any taxation system. The advantages of the platform include:

- automated reporting;

- conducting mutual settlements with counterparties, cash transactions;

- calculation of mandatory payments and wages;

- control of payment of bills, income and expenses, turnover volumes.

Document management is possible from any computer connected to the Internet. All information is stored in the cloud and has powerful cryptographic protection that prevents data leakage. You can understand the functionality of the platform yourself, while all document flow will comply with legal requirements. You can also use the packaged products 1C 8, 1C: Management of a small company 8 and others.

You can find out more about this on the Internet. For example, on this page you have the opportunity to get acquainted with information about 1c cloud http://systems36.ru/products/1s-v-oblake/

On the same topic:

Screaming and running away is useless: how to behave when meeting a bear

How many Soviet soldiers went missing during the Great Patriotic War?

How many Soviet soldiers went missing during the Great Patriotic War?

Good afternoon.

Federal Law on accounting

The law does not require the use of automated accounting systems.Article 6. Obligation to maintain accounting records

1. An economic entity is obliged to keep accounting records in accordance with this Federal Law, unless otherwise established by this Federal Law.

2. Accounting in accordance with this Federal Law may not be maintained by:

1) an individual entrepreneur, a person engaged in private practice - if, in accordance with the legislation of the Russian Federation on taxes and fees, they keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity ;

(clause 1 as amended by Federal Law dated November 2, 2013 N 292-FZ)

2) a branch, representative office or other structural unit of an organization established in accordance with the legislation of a foreign state located on the territory of the Russian Federation - if, in accordance with the legislation of the Russian Federation on taxes and fees, they keep records of income and expenses and (or) other objects of taxation in the manner established by the specified legislation.

3. Accounting is maintained continuously from the date of state registration until the date of termination of activities as a result of reorganization or liquidation.

4. The following economic entities have the right to use simplified methods of accounting, including simplified accounting (financial) reporting:

1) small businesses;

2) non-profit organizations, with the exception of non-profit organizations whose receipts of funds and other property for the previous reporting year exceeded three million rubles, bar associations, law offices, legal consultations, bar chambers, notary chambers, housing and housing-construction cooperatives, consumer credit cooperatives, agricultural consumer cooperatives, microfinance organizations, mutual insurance societies, public sector organizations, state corporations, state companies, political parties, their regional branches or other structural units, self-regulatory organizations, non-profit organizations included in the provisions provided for in paragraph 10 of Article 13.1 of the Federal Law dated January 12, 1996 N 7-FZ “On Non-Profit Organizations” register of non-profit organizations performing the functions of a foreign agent;

3) organizations that have received the status of project participants to carry out research, development and commercialization of their results in accordance with Federal Law of September 28, 2010 N 244-FZ “On the Skolkovo Innovation Center”.

(Part 4 as amended by Federal Law dated November 2, 2013 N 292-FZ)

(see text in the previous edition)

Article 7. Organization of accounting

1. Accounting and storage of accounting documents are organized by the head of the economic entity.

2. If an individual entrepreneur or a person engaged in private practice maintains accounting records in accordance with this Federal Law, they themselves organize the maintenance of accounting records and storage of accounting documents, and also bear other responsibilities established by this Federal Law for the head of an economic subject.

3. The head of an economic entity is obliged to entrust the maintenance of accounting to the chief accountant or other official of this entity or to enter into an agreement for the provision of accounting services, unless otherwise provided by this part. The head of a credit institution is obliged to entrust accounting to the chief accountant. The head of a small and medium-sized enterprise, as well as the head of a non-profit organization that has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, in accordance with this Federal Law, may take over the accounting.

(Part 3 as amended by Federal Law dated December 28, 2013 N 425-FZ)

(see text in the previous edition)

ConsultantPlus: note.

The provisions of Part 4 of Article 7 do not apply to persons who, as of the date of entry into force of this document, are entrusted with maintaining accounting records (Part 2 of Article 30 of this document).

4. In open joint-stock companies (except for credit organizations), insurance organizations and non-state pension funds, joint-stock investment funds, management companies of mutual investment funds, in other economic entities whose securities are admitted to trading in organized trading (except for credit organizations) , in the management bodies of state extra-budgetary funds, the management bodies of state territorial extra-budgetary funds, the chief accountant or other official who is entrusted with accounting must meet the following requirements:

(see text in the previous edition)

1) have a higher education;

(see text in the previous edition)

2) have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least three years out of the last five calendar years, and in the absence of higher education in the field of accounting and auditing - at least five years out of the last seven calendar years;

(as amended by Federal Law dated July 2, 2013 N 185-FZ)

(see text in the previous edition)

3) do not have an unexpunged or outstanding conviction for crimes in the economic sphere.

5. Additional requirements for the chief accountant or other official responsible for maintaining accounting records may be established by other federal laws.

ConsultantPlus: note.

The provisions of Part 6 of Article 7 do not apply to persons who, as of the date of entry into force of this document, are entrusted with maintaining accounting records (Part 2 of Article 30 of this document).

6. An individual with whom an economic entity enters into an agreement for the provision of accounting services must meet the requirements established by part 4 of this article. A legal entity with which an economic entity enters into an agreement for the provision of accounting services must have at least one employee who meets the requirements established by part 4 of this article, with whom an employment contract has been concluded.

7. The chief accountant of a credit organization and the chief accountant of a non-credit financial organization must meet the requirements established by the Central Bank of the Russian Federation.

(as amended by Federal Law dated July 23, 2013 N 251-FZ)

(see text in the previous edition)

8. In the event of disagreements regarding accounting between the head of an economic entity and the chief accountant or other official entrusted with accounting, or the person with whom an agreement has been concluded for the provision of accounting services:

1) the data contained in the primary accounting document is accepted (not accepted) by the chief accountant or other official entrusted with accounting, or by the person with whom an agreement has been concluded for the provision of accounting services, for registration and accumulation in registers accounting by written order of the head of an economic entity, who is solely responsible for the information created as a result;

2) the accounting object is reflected (not reflected) by the chief accountant or other official entrusted with maintaining accounting records, or by a person with whom an agreement has been concluded for the provision of accounting services, in the accounting (financial) statements on the basis of a written order of the manager an economic entity that is solely responsible for the reliability of the presentation of the financial position of the economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period.

But every organization is required to maintain accounting records. In principle, you can order accounting forms from a printing house the old fashioned way and fill them out with a pen. In any case, you should have them, since this is an accounting violation and fines for the company.

All these programs were invented with the goal of making the work of an accountant easier and not filling out paperwork by hand, but doing it automatically.

The use of 1C: Accounting is so developed today that they have come up with many ways to learn how to use this program:

Courses. In almost every city there are methodological centers whose list of services includes a 1C training program. For a set amount, they will teach you how to use the program and clearly explain the basics of accounting. It turns out theory and practice, all in one.

Educational books. Many tutorials and guides on this topic are published. This literature describes step by step each action or operation, provides a description of the specific configuration and the features of working in it.

Demo version. Typically, a disc with a demo version of the program is included with the self-instruction book. When launched from a computer, it simulates that you are working in a real program. A fictitious company is entered and then you can perform any actions that are within the competence of the program: fill out documents, generate reports, make entries, and perform other accounting-related actions.

Information from the Internet. This includes knowledge of 1C using Internet resources: websites, forums, discussions, online publications and magazines.

Direct work experience. This method is the best of all. If you have the opportunity to learn while performing a job function, getting acquainted with 1C will be quick and fruitful.

Getting started in 1C:Accounting

First you need to install the program on your computer's hard drive. Leave it to a specialist. After installation, in clean 1C you will need to enter all the data about the organization in which accounting is kept, these are details, accounting policies, and nomenclature used in the work. If initially all the settings are set correctly, then 1C will only work to help the accountant. In one program you can create several databases with different companies.

“1C: Accounting” has the ability to process personnel documents, hiring and dismissing employees, processing vacations, and accounting. Initially, all this data will need to be entered into the program. From time to time it is advisable to make an archive of the database in case of loss of information or computer breakdown. Also, as legislation changes and new releases are released, the program needs to be updated for correct operation and updating of data.

Since “1C: Accounting” is the development of one manufacturing company, it has its own individual interface developed over time and, despite constant improvements and updates, it will not be difficult for those who once learned to work in it to master the new version.

Related article

How to issue an invoice in 1C Accounting

“1C: Enterprise” is a computer application program with which you can automate the accounting of various areas of activity in any enterprise (accounting, personnel, finance, sales, etc.).

The computer program “1C:Enterprise” is a system of individual products and components, such as 1C: Trade and Warehouse, 1C: Salary and Personnel, 1C: Accounting, etc.

In order to rationally use all the capabilities of the program, you need to pay attention to the recommendations of the system itself, which are contained in the “Tips of the Day”. In addition, if you have any questions during your work, you can contact the employees who installed and maintain the program in the company.

Additional information for the user can also be obtained in the “action”, “context menu” menu sections, in the “help” mode, in the built-in description, and in pop-up tips. In addition, in the “Options” mode you can find additional system features.

Software products are constantly updated and re-released. Typically, service specialists monitor the timely installation of updates. You can view the version number installed on a specific work computer by calling the “About” mode (the “Help” menu).

Working with 1C begins with launching the program on the computer. Immediately after the program starts, the “Launch Window” appears, in it you can select one of the “1C:Enterprise” (for users) and “Configurator” () modes.

After selecting the “1C:Enterprise” mode, an interface configured for a specific user opens (by default, a menu and a standard panel will open). The main menus here required for work are “Operations” and “Service”.

In general, working with 1C looks like selecting the desired sections from the menu in the windows that open. All configurations have windows that help you navigate them or contain help information, for example, “help”, “workplace”, “navigation assistant”. You can find them in “Help—Function Panel—Quick Start—Additional Information—Start Assistant.” The main actions that you will have to perform when working in 1C: Enterprise are entering and adding information to the directory, completing (filling out) documents, and viewing reports.

Detailed step-by-step instructions can be found on the Internet on developer websites or on user forums.

The “Configuration” mode allows you to create an application solution for a specific enterprise, taking into account the specifics of its production activities, personnel and financial policies. This mode is used exclusively by programming specialists.

Related article

Sources:

- how is work in

Tip 3: How to learn to use the 1C Accounting program

It is very difficult to imagine the work of modern companies without using the 1C Accounting program. This application has simplified many tasks. In order to learn how to work in it, you need to make an effort and have the desire. The main thing is to set a goal and try to achieve it, doing everything possible for this.

There are different training options. You can study this program on your own or with the help of a specialist. Finding a specialist is not difficult, as there are many courses where you can gain the necessary knowledge.

Some people prefer to learn new programs on their own, while others simply do not have the time to attend courses. In order to study the program yourself, you will need a textbook on accounting and, accordingly, the 1C Accounting program. Practical tasks will also not be superfluous.

Without certain knowledge in the field of accounting, it will be difficult for a person to master the program. For clear learning, you need to know the chart of accounts and be able to fill out everything in a certain way. Accounting courses will also not be superfluous. In work, the acquired knowledge and skills will never be superfluous.

If you decide to study the program yourself, you need to make sure that your knowledge in this area will be sufficient for the job. This area is quite difficult to study. Sometimes even experienced accountants find it quite difficult to understand this program.

It is recommended to download a quick guide to help you get started with the program faster. You can also learn by watching video tutorials. To study, you need to know the latest events related to accounting, as well as tax accounting.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Introduction

Bibliography

Introduction

Currently, there are several dozen relatively well-known software products, but without exaggeration we can say that the 1C software, designed to automate various types of accounting - accounting, warehouse, trade, etc., is the most widespread and popular in Russia and CIS.

"1C: Accounting" version 7.7 is, in fact, one of the functional components of the technological (software) platform "1C: Enterprise".

There are only 3 such components, which, according to the developers, should maximally cover the area of various accounting tasks.

The “Operational Accounting” component is designed to automate the accounting of business operations of an enterprise in real time. For example, to automate warehouse and trade accounting.

The “Calculation” component can be used to automate complex types of periodic calculations, for example, payroll calculations in a large enterprise with a lot of structural divisions, etc.

And finally, the “Accounting” component, which is discussed in the test, is designed to automate accounting of almost any complexity.

The purpose of the test is to study the information system “1C: Accounting” version 7.7.

Thus, the object of study is the subsystems of the 1C: Accounting program; the subject is the reflection of business accounting transactions in this program.

In the course of studying the material, the literature sources of the following authors were used: Mushtovatogo I.F., Baidakova V., Dranishchev V., Krayushkina A., Kuznetsova I., Lavrova M., Monicheva A. and others.

1. Maintaining accounting records in practice in the 1C: Accounting program

1.1 Operations for accounting of finished products

In the "1C: Accounting" configuration, the method of accounting for finished products is set by a periodic constant in the "Operations" menu, which is called "Method of accounting for finished products and semi-finished products."

Before starting to work with the program, you must fill out the directory “Types of products, works, services”, defining for each element of the directory the “Type of item” (for finished products this is “Products”, respectively). The elements of this directory are objects of analytical accounting on account 20 (subaccount 1).

During the month, production costs are collected on the debit of account 20 for each type of product and by cost item. In order for production costs to be attributed to the cost of a certain type of finished product, in all reference books and documents where account 20 is used, it is necessary to indicate the type of product in the cost of which these costs should be included. For example, when filling out the “Employees” directory for employees directly involved in the production process, it is necessary to indicate the cost of which products the salary of a particular employee relates to.

Let's consider the method of accounting for finished products at actual cost using the example of an enterprise that produces several types of products.

Let us consider sequentially the stages of the production cycle:

2. Third party services.

3. Product release.

5. Closing the month.

1. Release of materials into production.

The release of materials into production is carried out using the document “Movement of materials”.

In the document, you select the type of transfer "Transfer to production", cost allocation account 20 and the type of item for the production of which materials are transferred. Below are the transactions that are generated when posting a document (in our case, the release of materials for the production of paving slabs):

2. Third party services. In the document “Services of Third Party Organizations”, account 20 is selected as the corresponding account, and the name of the material is selected as subaccount 1.

3. Product release.

The release of products is carried out in the program by the document “Transfer of finished products to the warehouse”. When finished products arrive at the warehouse during the month, we do not always know their actual cost (for example, wages and depreciation will be expensed only at the end of the month), so finished products are delivered to the warehouse at the planned cost (the “Cost” column of the document). To automatically enter the planned cost into a document in the "Nomenclature" directory, the "Planned cost" attribute must be filled in for the manufactured products, that is, the approximate amount of costs for the production of one unit of this product. When calculating the cost of production, the postings will be generated based on the planned cost specified in the document; in our example, the documents “Transfer of finished products to the warehouse” will generate the postings:

4. Sales of finished products.

For this purpose, a document “Shipment of goods, products” is created. In the document, the sales price is indicated in the “Price” column, and the following transactions are generated:

Debit 90.2.1 “Cost of sales not subject to UTII” Credit 43 “Finished products”.

Debit 62 “Settlements with buyers and customers (in rubles)” Credit 90.1.1 “Proceeds from sales not subject to UTII”

5. Closing the month.

Closing the month is the final stage of the production cycle, a document that closes accounts 20 and 40, which, in the absence of work in progress, should not have balances at the end of the month. It would not be amiss to remind you that before generating the “Month Closing” document, it is necessary to post all the documents that form the postings to the debit of account 20, including payroll and depreciation.

When performing the action "Calculation and adjustment of the cost of GP and PF" (which is performed when posting a document for closing the month):

1. Account 20 is closed to the debit of account 40 in terms of expenses attributable to the cost of products released in the current month;

2. Direct costs are distributed to the cost of manufactured products (written off from account 40);

3. Adjustment of product write-off transactions to its actual cost.

When posting the “Month Closing” document with the “Generate report when posting document” checkbox selected, you can generate a report that will allow us to consider in detail how the cost of finished products was calculated and adjusted.

In the month-end report, the lines that are highlighted in a darker color and underlined are so-called “links” that can be expanded with a mouse click. In our example, the lines “Calculation of the cost of manufactured products and semi-finished products” and “Adjustment of the cost of products and semi-finished products” will be underlined. The data in this report coincides with the analysis of account 20 for subconto, but is presented in a more visual form. In addition, the amount of direct costs that “fell” on the cost of each type of product by cost item can be deciphered by double-clicking in column 4 of the corresponding row of the table.

Column 7 can also be deciphered by double-clicking the mouse, which produces a report on the type of product, which compares its planned and actual costs.

A negative adjustment is obtained if the planned cost of manufactured products (which we indicated in the document “Product Output”) exceeds the actual amount of costs for the production of these products, a positive adjustment - if the amount of costs for the production of products exceeds the planned cost of production.

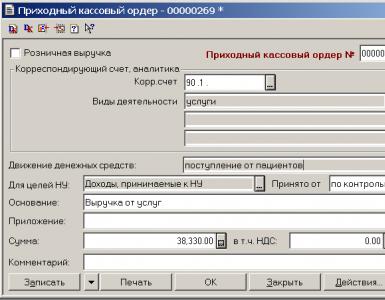

1.2 Current account transactions

accounting operation payroll accounting

1. The supplier's invoice for materials that should arrive at the warehouse has been accepted for payment.

To pay for the receipt of materials, it is necessary to draw up a payment order to the bank based on the invoice presented by the supplier of materials. To issue a new document, select “Payment order” from the “Documents” menu. It indicates the current account from which the recipient should receive funds. There is a button in the upper left corner of the document form for this purpose. Next to the button it is indicated which current account and in which bank you have selected. By default, this is the main current account, which is indicated on the Bank tab when filling out information about the organization. The account is selected from the organization's "Bank Accounts" directory.

The number and date of the payment order are indicated in the relevant details of the form. The “Recipient” detail is selected from the “Counterparties” directory.

The details “Recipients' account” and “Recipient's checkpoint” are filled in automatically when selecting a recipient from the directory. If necessary, the recipient's account can be changed by selecting another account from the "Current Accounts" directory, subordinate to the "Counterparties" directory. The payer's checkpoint is set automatically when choosing your account.

When drawing up a payment order, no entry is generated in the Business Transactions Journal. All saved payment documents are located in the “Payment Documents” journal.

Since the accounting policy does not provide for conducting transactions on account 15, as well as on account 16, the LLC Leader company creates a document “Payment order” without postings when accepting invoices for payment.

1. Paid to the supplier for materials. An operation involving the movement of funds on an organization's current account. The “Extract” document is received by the accounting department from the bank along with payment orders from another company and bank memorial orders. It reflects the initial balance as of the current date when the transactions were made, income and expenses, and the final balance in the bank account of the given enterprise. To enter this document, you must select “Extract” from the “Documents” menu. The document indicates the current account of the organization. By default, the program uses the main current account from the information we entered about the organization. Then you need to select the type of statement (ruble). By pressing a key, a new row is entered into the table section. First you need to select the type of cash flow from the directory, the number and date of the payment order or memorial order, enter the purpose of the payment, and select the corresponding account (60). Select “Subconto” - the name of the counterparty and the agreement, “Type of subconto” - is entered automatically. Indicate the amount of income or expense. In this case - expense. Next, select the number and date of the payment order from the “Payment Documents” journal, after which a tick is placed in this journal. The “Bank Statement” document automatically generates the specified transactions in the Transaction Journal, which can be accessed through the “Transactions” menu. All documents of this type are stored in the Bank journal.

1.3 Operations for accounting materials in the warehouse

1. The person receiving materials from the supplier’s warehouse provides the “Power of Attorney” document to this warehouse. Printed forms of the power of attorney correspond to the standard interindustry form No. M-2 and No. M-2a. The document is located in the Documents - Power of Attorney menu.

The head of the document indicates the employee of the organization to whom the power of attorney is issued. It is selected from the “Employees” directory. The supplier is selected from the “Counterparties” directory.

This information is then duplicated in the corresponding document details. Next, if necessary, enter the document that provides the basis for obtaining the inventory, its number and date.

The tabular part is filled out in the following ways:

The line is entered either manually, that is, from the keyboard, and the unit of measurement of the inventory items and their quantity are indicated.

By pressing the Select button. Only, unlike the previous document, the program will first offer to select inventory items, and only then open the corresponding directory window for selection.

The printed form of the power of attorney is formed with a tear-off spine. To do this, use the “Print” button. The “Power of Attorney” journal is located in the “Journals” menu. Its additional columns are “Employees” and “Supplier”.

2. Materials have been received into the warehouse from the supplier.

The document “Receipt of goods” is intended for this operation.

The document is located in the menu Documents - Materials Accounting - Receipt of Materials. First, you need to fill in the details “Type of receipt”, and depending on it, you then need to select the details “Supplier” and “Contract”. To do this, you need to select information from the “Counterparties” directory and the subordinate “Contracts” directory. After that, fill in the “Warehouse” details. The “Storage Locations” directory is “attached” to it, where you need to select the warehouse to which the goods are received. In the “Advance offset” detail, you must select one of the options:

Do not read out;

Only by agreement;

Without specifying a contract.

In the lines you need to enter the names of materials according to the invoice from the supplier, selecting them from the nomenclature directory. Postings in the Business Transactions Journal are generated for each row of the tabular part of the “Receipt of Materials” document. The debit part of the transaction indicates account 10.1, the name of the specific material and its storage location.

The credit part of the posting is account 60.1 “Settlements with suppliers in rubles, indicating the counterparty and the agreement. For each received material, its quantity must be indicated. The following units of measurement are used to account for materials in warehouses: kilograms, meters, pieces. All documents in the “Material Accounting” section are stored in the journal of the same name. In its columns you can find information about the type of documents contained in the journal, their amount and the object where they were recorded and transferred, or from whom they were received.

1.4 Operations for accounting settlements with personnel for wages

Accounting for personnel remuneration is kept on balance sheet account 70. Analytical accounting is organized by subaccount “Employees” and “Types of accruals”, which correspond to the elements of the directory “Employees” and “Types of accruals (payments)”. It is located in the Directories menu - Employees and Types of accruals. The employee directory has a three-level structure, which makes it possible to flexibly organize analytical accounting for the organization's employees.

The directory element form includes five tabs on which various information about the employee necessary for payroll calculation is grouped.

The “General Information” tab contains basic information about the employee. You must enter the following information into its details:

Personnel TIN number of the employee;

His last name, first name, patronymic;

Gender, date of birth, Pension Fund No., country of permanent residence, position;

The department in which the employee works - by selecting from the “Divisions” directory. For example, “Administration” or “Workshop”. Using the “Nature of work” switch, indicate what type of employment relationship is established with the employee: “Principal place of work” or “Work under a contract”;

Hiring date;

Date of dismissal, if necessary.

On the “Salary Accrual” tab there are details in which the following information is entered to calculate the employee’s salary: the employee’s monthly salary, the account for allocating costs for accrued wages and its analytical characteristics.

The next tab, “Taxes and Deductions,” includes the data necessary to calculate personal income tax. The following information must be entered into its details:

Personal income tax balance at the beginning of the current year;

Type of deduction - by selecting from the list;

Number of children - when calculating the tax, an additional deduction of 600 rubles will be provided for each child, until the amount of total annual income exceeds the established deduction limit.

The two remaining tabs contain information about the initial data for calculating tax and passport data. In their details, accordingly, it is required to indicate gross income from the beginning of the year (if the employee has not been working in the organization since the beginning of the year) and all the details of the employee’s passport. After entering all the data about the employee, the directory element must be recorded by clicking the OK button.

Also, being in the directory form, you can print reports for one or all employees on a working date, as well as enter orders regarding personnel records. The buttons Report for all employees, Report for employee, New order are intended for this purpose.

The “Payroll” document is intended for automatic calculation and payroll. The document is located in the menu Documents - Salary - Payroll.

As a rule, the last working day of the month for which the salary is calculated is selected as the date of the document. In the “Division” detail, you need to select the department whose employees should receive salaries. If the division is not selected, then the salary will be accrued to all employees of the organization. The tabular part of the document can be filled out by manually entering lines - by selecting employees from the list or using a button<Заполнить>. In the latter case, the program will automatically fill in the rows of the tabular section with employees of the selected division (or the entire organization) and enter their salary in the appropriate column. The amount of accrued salary in the amount of salary can be adjusted manually. After all the details of the header and table part are filled in, it must be done using the button of the same name.

The program will automatically generate all the necessary transactions.

Dt 26 Kt 70 Dt 70 Kt 68

Dt 20 Kt 70 Dt 70 Kt 68

The first entry reflects the payroll transaction for this employee. The second entry determines the calculation of the calculated personal income tax for this employee. After posting the document, you can print pay slips and payslips for each employee using the Print button.

2. Brief overview of payroll and personnel accounting operations in the 1C: Accounting 8.0 program

Personnel accounting.

The personnel of the enterprise are considered to be all individuals registered as “employees” of one of the enterprise’s organizations (for them the “Hiring” document has been completed).

Hiring to an enterprise can be carried out in compliance with the following restrictions arising from the labor legislation of the Russian Federation: the same person (in our terminology - an “individual”) can be registered as an employee of several organizations. But, at the same time, his main place of work can only be in one of them - in other organizations he must be registered as an external part-time worker.

The document “Employment Order” also indicates all the basic data necessary for calculating wages, namely:

Salary - the amount that will be offered as a result of accrual after filling out the “Payroll” document;

The method of reflection in accounting is the method of recording the amount accrued to the employee.

In the directory of individuals, when creating a new or editing an existing element, data for calculating personal income tax is indicated (the “personal income tax” button on the command panel), namely:

Deductions - for automatic accounting of standard deductions to which an individual is entitled according to the law: for the individual himself, subparagraphs 1-3 of paragraph 1 of Art. 218 Tax Code of the Russian Federation; for children, subparagraph 4 of paragraph 1 of Art. 218, for this deduction you must indicate the number of children.

Deductions in accordance with subparagraphs 3 and 4 of paragraph 1 of Art. 218 of the Tax Code of the Russian Federation are provided if the total income of an individual does not exceed 20,000 rubles. - this condition in the program is controlled automatically;

Data from the previous place of work - data on income at the previous place of work to control the total income of an individual in the form of 12 amounts for the specified year.

All calculations of accruals and deductions are carried out directly in the form of the “Payroll” document (see the “Salary” menu).

Thus, any accrual is carried out according to the following scheme: a list of employees working in the next month is filled in, the amount of their salaries is filled in, and the amount of personal income tax is automatically calculated.

If necessary, the calculated amounts are adjusted; personal income tax amounts are recalculated taking into account the adjustments made, usually automatically, for which the “Calculate personal income tax” button is intended; If necessary, the calculated personal income tax amounts are adjusted.

Personal income tax for tax residents of the Russian Federation is calculated automatically at a rate of 13% on all income of an individual accrued to him as an employee of an organization on an accrual basis from the beginning of the tax period. Personal income tax for employees who are tax non-residents is calculated automatically at a rate of 35% separately for each month’s income. The document is posted - previously calculated amounts (or entered directly into the document) are registered as an accrual.

The results of payroll calculations must be reflected in accounting and tax accounting with varying degrees of detail, regardless of whether they are performed automatically or not.

The document “Reflection of salaries in accounting” is intended to solve this problem. The document contains a button to automatically fill part with accounting data. In automatic mode, the document is filled out based on the data for calculating wages and taxes from the payroll, performed in the payroll calculation subsystem, and based on the methods specified by the user for reflecting wages in accounting and tax accounting (menu “Salary” - “Personnel Accounting” and document data “Order about hiring").

While preserving the methodological heritage of 1C: Accounting 7.7, the eighth version has many significant advantages:

1. The ability to maintain records of several organizations in a single information base has been implemented. It is possible to use general lists of goods, cost items, contractors, etc., which eliminates the need for double entry of information and allows you to maintain complete accounting consolidation.

2. Simplified taxation system. Accounting under the simplified taxation system (STS) is implemented on a separate chart of accounts. Moreover, each organization can keep records using a general or simplified taxation system within the same information base.

3. A separate chart of accounts for tax accounting has been introduced. The comparability of accounting and tax accounting data has been simplified, which is important to meet the requirements of PBU 18/02 “Calculations for income tax.” In the new configuration, the accounting of distribution costs, the accounting of indirect costs (the “Direct Casting” method), as well as the write-off operation are automated.

4. Party registration has been introduced. The flexibility of accounting within the framework of PBU 5/01 “Accounting for Inventory and Inventory” is significantly increased. In the new program, you can apply various valuations of inventory upon disposal, such as FIFO, LIFO and average cost, independently for accounting and tax accounting of one or more organizations.

5. Optional analytical accounting by storage location has been implemented. Quantitative or quantitative-total accounting can be maintained for warehouses. In the first case, the assessment of inventories for accounting and tax purposes does not depend on the warehouse from which they were received. The ability for users to customize reports has been significantly expanded. For the first time, the 1C program contains an interactive report builder that allows you to generate any custom reports without the participation of a programmer.

Bibliography

1. Baidakov V., Dranishchev V, Krayushkin A, Kuznetsov I, Lavrov M, Monichev A. 1C: Enterprise 8.0 Description of the built-in language. In 4 volumes. - M.: Firma "1C", 2004. -257 p.

2. Belousov P.S., Ostroverkh A.V. 1 C: Enterprise 8.0 from 8.1. Practical guide. - M.: LLC “1C-Publishing”, 2008.-286 p.

3. Gabets A.P., Goncharov D.I., Kozyrev D.V., Kukhlevsky D.S., Radchenko M.G. Professional development in the 1C system: Enterprise 8. - M.: LLC “1 S.-Publishing”; St. Petersburg: Peter, 2007.-808 p.

4. Gladky A. A. 1C: Enterprise 8.0. - St. Petersburg: Triton, 2005. - 256 p.

5. A set of questions for the certification exam for the program “1C: Trade and Warehouse” version 7.7 with examples of solutions. - M., 2007. - 112 p.

6. Mitichkin S.A. Development in the 1C Enterprise 8.0 system. - M.: 1C-Publishing LLC, 2003. - 413 p.

7. Mushtovaty I.F. Computer for an accountant. 1 C: Accounting 7.7/8.0/ I.F. Mushtovaty, E.E. Balabaichenko, G.N. Lebedeva - Rostov-on-Don: “Phoenix”, 2005. - 348 p. - (Tutorial)

8. On the release of new editions of standard configurations “Accounting” and “Trade + Warehouse” of the program system “1C: Enterprise 7.7” - M., 2005

9. Radchenko M.G. 1C:Enterprise 8.0. Practical guide for developers. Examples and typical techniques. - M.:, LLC “1C-Publishing”, 2004. -656 p.

10. Radchenko M.G. 1C: Enterprise 8.1 Practical guide for developers. Examples and standard techniques.-M.: LLC “1C-Publishing”. St. Petersburg: Peter, 2007.- 512 p.

11. Sushchenya V.V. Solving payroll and personnel accounting problems. Methodological materials for students of the certified course. - M.:, LLC “1C-Training Center No. 3”, 2004. -116 p.

Posted on Allbest.ru

Similar documents

Possibility of loading the configuration of the program "1C: Accounting 8", standard settings. Maintaining accounting records in this program, working with documents. Principles of accounting and tax accounting in the program, creating different forms of reports.

course work, added 12/19/2012

Software system of the company "1C". The concept of the program "1C: Accounting 7.7". Tax accounting in the program "1C: Accounting 7.7". The concept of tax accounting in the program "1C: Accounting 7.7". Formation of income tax return. Benefits of the program.

course work, added 10/02/2008

Accounting and tax accounting of finished products. Concept and classification of a manufacturing enterprise. Review of existing software for automation of finished product accounting. Application of an automation system for accounting of finished products.

thesis, added 11/20/2013

1C: Accounting is a program for accounting of various types of commercial activities. The order of work in the program for each day. Chart of accounts for accounting financial and economic activities of organizations. Cash, banking operations.

training manual, added 10/06/2009

Development of a design solution for accounting for finished products, work performed, services provided based on a specialized package of the application program "1C: Accounting 7.7". Information support of the subject area. Example of system testing.

thesis, added 05/31/2014

The main advantages of accounting in the program "1C: Accounting 8". Characteristics of the main functional and additional capabilities of this program. Description of the execution of a cross-cutting task. Features of payroll calculation in this program.

practice report, added 04/06/2011

Organization of analytical and quantitative accounting. Entering initial balances for the opening balance. Accounting for transactions on a current account, cash account and foreign currency account, accounting for settlements with accountable persons. Primary documents on the movement of fixed assets.

training manual, added 11/18/2011

Automation of materials accounting. Concept and methodology for maintaining synthetic and analytical accounting of fixed assets at the SPS "ConsultantPlus" enterprise; reflection of business transactions in the program "1C: Enterprise Accounting 8.2".

course work, added 09/22/2012

The economic essence of the concept and the composition of finished products, its evaluation and the main tasks of accounting. List of articles on accounting of finished products. Documentation of the movement. Organization of accounting in the warehouse and in the accounting department. Synthetic and analytical accounting.

course work, added 12/03/2011

Basic techniques for working with the 1C: Accounting program. Accounting for transactions on the current account and cash register, forms for creating a payment order, incoming and outgoing cash orders. Creating an account, methods for entering accounting forms into the information base.

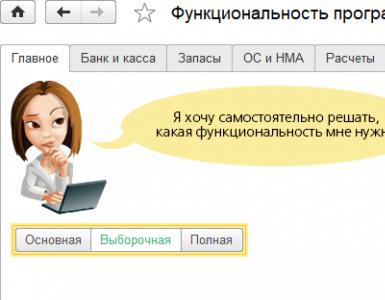

Setting up accounting parameters in 1C 8.3 is one of the first actions you must take before starting full-time work in the program. The correct operation of your program, the availability of various functionality and accounting rules depend on them.

Starting with version 1C:Accounting 3.0.43.162, the interface for setting up accounting parameters has changed. Also, some parameters began to be configured separately.

Go to the "Administration" menu and select "Accounting Settings".

This settings section consists of six items. Next we will look at each of them. All of them allow you to influence the composition of subaccounts for certain accounts and subaccounts.

Initially, we already have flags set in two items that cannot be edited. You can also additionally enable maintenance by accounting methods.

This setting was also completed. The item “By item” cannot be used, but other settings can be edited if necessary. The list of accounts and subaccounts that are affected by these settings is shown in the figure below.

Here the management of subaccounts 41.12 and 42.02 takes place. By default, only warehouse accounting was installed. It is predefined and we cannot edit it. In addition, this type of accounting can be maintained according to the nomenclature and VAT rates.

Cash flow accounting

This type of accounting will necessarily be carried out according to the account. It is also recommended to additionally take into account in 1C 8.3 the movements of DS according to their items for additional analytics on management accounting.

You can keep records of this type of settlement both for employees as a whole, and for each individual. These settings have a direct impact on subaccounts 70, 76.04 and 97.01.

Cost accounting will necessarily be carried out by item groups. If you need to prepare audited statements in IFRS, it is advisable to also keep records of cost elements and items.

Salary settings

To go to this settings package, you need to follow the hyperlink of the same name in the accounting parameters form. Many of the settings here should be left at default, but you still have a lot of room for action.

General settings

To complete the example, we note that salary and personnel records will be maintained in this program. Of course, there are limitations here, but if your organization does not have many employees, then the functionality of 1C:Accounting will be quite sufficient.

You will see a list of settings for each organization that is accounted for in the program. Let's open the settings for Confetprom LLC.

Here you can indicate how wages will be reflected in the accounting system, the timing of their payment, vacation reserves and any special territorial conditions.

Let's go back and follow another hyperlink.

Among other things, you can also change the way the list of employees is organized in documents and make settings for printed forms.

Allows you to configure lists of types of charges and deductions. Initially, they are already filled with some data.

Also, in this section 1C you can enable the availability of functionality for sick leave, vacations and executive documents. The setting is available only if the database does not contain organizations that employ more than 60 people.

The last setting is very useful, since when editing all its amounts will be recalculated automatically.

This section is necessary to indicate methods for allocating labor costs and mandatory insurance contributions from the payroll to accounting accounts. Initially, these settings are already filled in, but, of course, you can adjust them.

Personnel records and Classifiers

There is no point in describing these last two sections in detail, since everything here is intuitive. Classifiers are already filled in and often leave these settings untouched.

Other settings

Let's go back to the accounting parameters form and briefly consider the remaining settings items.

- Payment terms for suppliers and buyers determine after how many days the buyer’s debt to us will be considered overdue.

- Printing of articles– setting up their presentation in printed forms.

- Filling in prices sales allows you to determine where the price will be inserted into the relevant documents.

- Type of planned prices influences the substitution of prices in documents related to production.

Some of these 1C 8.3 settings were previously made in the accounting parameters. Now they are placed in a separate interface. You can also find it in the “Main” menu.

The setting form is shown in the figure below. Here, going through sections, you can set up income tax, VAT and other data.