Accounting info. Accounting info Where 1s 8.3 insurance premiums

21.09.2018 17:33:15 1C:Servistrend ru

Calculation of insurance premiums in 1C 8.3

Many accountants are concerned about the question of how to correctly calculate insurance premiums in 1C 8.3 Accounting. The configuration functionality allows you to perform this operation. The first step is to make the appropriate settings in our information database. To do this, go to the “Salaries and Personnel” section and then select the “Salary Settings” item.

Let's return to the main salary settings menu and go to the “Salary accounting procedure” section in the “General settings” item. Next, let’s go to the accounting settings of a specific organization, if there are several of them in the information base, and in the window that opens, click on the “Setting up taxes and reports” hyperlink.

We will be interested in the “Insurance premiums” section. It should be noted that the minimum tariff rate for NS and PP is 0.2%. In addition, it is possible to set up additional contributions for certain professions who are entitled to them.

You can also set a setting according to which voluntary insurance contributions for a funded pension will be transferred. Cost items for insurance premiums are determined in the “Reflection in accounting” section of the salary settings. To do this, you need to follow the hyperlink “Items of costs for insurance premiums”.

The next step is setting up the payment of insurance premiums for various accruals - vacation, salary, sick leave and others. To do this, in setting up your salary in the “Payroll calculation” section, click on the “Accruals” hyperlink. A list of all existing accruals will open and then for each accrual you can set the appropriate value in the “Type of income” field.

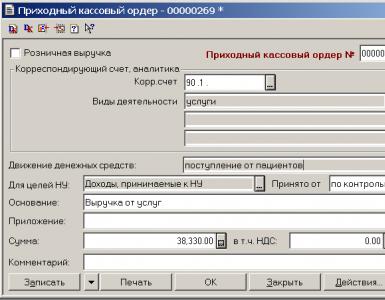

Contributions are calculated along with the salary in the “Salary calculation” document. Accrued contributions can be viewed on the “Contributions” tab. The data is calculated automatically by the program, but it is possible to adjust the amounts manually.

Let's look at the document entries, namely the entry we are interested in, “Social Insurance Calculations”. The program by default assigned it to account 69.01 for Credit and account 26 for Debit.

There is also the possibility of recalculating contributions. Here you cannot do without the document “Recalculation of insurance premiums” in the “Salaries and Personnel” section. In the new document we indicate the month of registration, period and organization. If you do not need to change the data for previous periods, then just check the first box “Independent additional calculation of contributions to correct errors,” otherwise check the box next to the second box. Then click the “Calculate” button.

In order to reflect the payment of contributions, we will enter a bank statement document. To do this, go to the “Bank and cash desk” section and select the “Bank statements” item. Next, in the window that opens, click on the “Write-off” button. Let's fill out the created document.

In the “Type of transaction” field we indicate that this is a tax payment and in the “Tax” field we set the value “Insurance contributions to the Social Insurance Fund”. After filling out the necessary details, we submit the document. Report 4-FSS “Calculation of accrued and paid insurance premiums” must be submitted to the regulatory authority quarterly. To generate a report, in the “Salaries and Personnel” section, select the “Reporting to the Social Insurance Fund” item. Next, click “Create”. Select the period and organization and in the open window click “Create” again.

After this, an empty report form will open, which must be filled out using the appropriate button, checked for errors and sent to the regulatory authority.

If you still have questions about conducting documents in 1C 8.3, we will be happy to answer them as part of a free consultation.

How to calculate insurance premiums in the 1C Accounting 8.3 program?

The program “1C Accounting 8.3” (rev. 3.0) allows, in accordance with current legislation, to calculate and accrue all necessary insurance contributions to employees’ salaries for the purpose of further payment of contributions and reporting. In order for the automatic calculation of contributions to be correct, the appropriate settings must be made in the system.

Contribution accounting settings

The taxation system used in the organization must be indicated in the accounting policy. Settings related directly to contributions are set in the same form as “salary settings”:

Salary and personnel/ Directories and settings/ Salary accounting settings

Here in subsection 1C 8.3 “Contributions: tariffs and income” you can preview background information: a list of current discounts, types of contribution income, values of the maximum base value, types of tariffs.

All these directories are already filled by default with data that is relevant at the time of release of the current version of the program. It is possible to add or edit them manually.

To directly set up contributions, you need to go to the “Main” subsection in the same form and open the salary accounting settings form for the organization. In it, on the “Taxes and Payroll Contributions” tab, you should fill in:

- Type of insurance premium rate and the period from which it is valid. Tariff types are available that correspond to the applicable taxation system (OSN, simplified tax system, UTII).

- Parameters for calculating additional contributions. If our organization employs people in professions such as pharmacists, miners, members of flight crews or crews of sea vessels, you need to check the box and fill out a list of positions or vessels for this category (they are available via the links). Marks are also placed here in case of employment of workers in difficult or harmful working conditions and the use of a special assessment of working conditions.

- Contributions from NS and PP. It is necessary to indicate the contribution rate approved for the organization by the Social Insurance Fund.

Charges subject to contributions in 1C

Each employee is assigned an accrual for payroll calculation. There are also accruals for paying sick leave or vacation. All of them are available in the accrual directory.

Salaries and personnel/ Directories and settings/ Accruals

In the accrual form there is a “Type of income” detail, which determines whether this accrual will be subject to contributions. The reference book already contains the accrual “Payment based on salary”, which has the type of income “Income fully subject to insurance contributions”, and accruals for sick leave with the type of income called “State benefits of compulsory social services”. insurance paid at the expense of the Social Insurance Fund.”

If you need to create new accruals, you must correctly indicate the type of income for them.

Cost items for insurance premiums

Cost items are needed for proper accounting of contributions. The program already has articles that are used by default: “Insurance contributions” and “Contributions to the Social Insurance Fund from NS and PZ” (as well as similar articles for UTII). Their list is in a special directory. Please note that cost items for contributions are “tied” to cost items for accruals.

Salaries and personnel / Directories and settings / Cost items for insurance premiums

If you need to use other items, you can add them to the directory, indicating the connection with cost items for accruals.

Calculation of insurance premiums

This operation is performed automatically by the standard document 1C 8.3 Accounting “Payroll”, simultaneously with payroll.

Salary and personnel/ Salary/ All accruals

Once employee accruals are completed, the Contributions tab displays the calculated premiums. The calculation is carried out according to the type of contribution tariff for a given organization, as well as the types of income accruals.

When carried out, this document, in addition to postings for payroll, also generates accounting entries for calculating contributions. Postings are made to the debit of the same accounting accounts to which the salaries of these employees are attributed, and to the credit of the subaccounts of accounting account 69 “Calculations for social services”. insurance and security." Cost items for insurance premiums are used as analytics.

Analytical reports on insurance premiums

Salary and HR/ Salary/ Salary reports

The report “Taxes and contributions (briefly)” – displays for a given period for each employee and a summary of accrued contributions and personal income tax.

The report “Analysis of contributions to funds” - displays an analytical table for each type of contribution in the context of tariff types and charges, displaying non-taxable charges and excess of the maximum base (if any).

Here, in the “Salary Reports” section, a unified “Insurance Contributions Accounting Card” is available. It can also be generated from the “Payroll” document (the “Contributions” tab).

Based on materials from: programmist1s.ru

To view the type of insurance premium tariff in 1C 8.3 without NS and PZ, open the tab Insurance premium rates:

Let’s set the tariff for Taxpayer Invoices and Taxpayer Orders by selecting the bookmarks Salary settings – :

And set the start date for applying the tariff in the 1C 8.3 Accounting database:

In 1C 8.3 you can view the tariffs in force in previous periods using the function Story.

Where in 1C 8.3 to change the rate of insurance premiums for accidents

On the bookmark Salary and Personnel choose Salary settings:

In this register, it is useful to view the maximum amounts of insurance premiums by year and set the tariff for contributions from accidents and occupational diseases (AS and OZ):

Basic tariffs for non-state funds in the 1C 8.3 Accounting database are set by default. However, the tariff for NS and PP must be set independently.

Let us remind you that the tariff for tax and income tax is set depending on the main type of activity for the previous year. To do this, documents are submitted to the FSS annually. The minimum tariff for NS and PP is 0.2%.

To view the maximum value of the base in 1C 8.3 Accounting, you must select the tab Limit value of the insurance premium base:

Reflection of insurance premiums in accounting

Accounting for transactions on insurance premiums is reflected in account 69 Calculations for social insurance and security.

To determine the cost accounting account, it is necessary to determine in which departments the employees work (administrative, production, support, sales personnel, etc.). Thus, the accrual of contributions is reflected in the debit of the following cost accounts:

- Account 08 – for employees involved in the process of creating future fixed assets;

- Account 20 – for production personnel directly involved in the production process (release) of products;

- Accounts 23, 25, 28, 29 – for personnel who are indirectly related to the production process;

- Account 26 – for administrative personnel;

- Account 44 – for personnel engaged in trading activities (salespeople, managers, drivers, cleaners, etc.);

- Account 91 – for employees who are engaged in non-core activities.

By default, the 1C 8.3 Accounting program already has accounting account 26 installed - the most commonly used among cost accounting accounts:

- Account 26 for the entire organization can be used by organizations engaged in the provision of services.

- Also, account 26 can be used in accounting by production and trade organizations to account for the calculation of wages and contributions of administrative personnel.

Calculation of insurance premiums in 1C 8.3 Accounting is generated automatically when registering Payroll:

In the general list, select the desired salary month:

Open the window and start viewing already automatically calculated insurance premiums:

In 1C 8.3 Accounting, it is possible to view transactions (accounting records) for cost accounts (accounts 08, 20, 23, 25, 26, 28, 29, 44, 91) by clicking on the function DtKt:

How to set up cost items for insurance premiums in 1C 8.3 Accounting

For each type of accrual in the 1C 8.3 program the following are specified: Salary and personnel – Salary settings – Accruals:

Right click and select function Change, you can view which account will reflect this or that type of accrual and the insurance premiums directly related to it:

As it was written earlier, it is important to determine which account to assign the accrual of wages and contributions depending on the employee’s activities. For example, if an employee belongs to the administrative staff or the organization is engaged in providing services, then all expenses will be reflected in account 26.

It is worth noting that in 1C 8.3 Accounting, the account for accounting for the costs of insurance premiums is inextricably linked with the account for accounting for the costs of payroll. Therefore, by selecting an account for a specific accrual, the 1C 8.3 program will assign accrued contributions to the same account.

It should also be noted that the accrual of benefits at the expense of the Social Insurance Fund is not included in cost accounts. The accounting record of accrued benefits will look like this:

- Dt 69.01 subaccount Insurance costs;

- Kt 70 Payroll calculations.

In order to view the accrual and payment of insurance premiums for any period (month, quarter, half-year, year, etc.), a balance sheet is generated in 1C 8.3 Accounting. To create it, you need to select bookmarks Reports – Account balance sheet:

How reports are generated to the Pension Fund of Russia, extra-budgetary funds and the tax authority in 1C 8.3 Accounting

Information on accrued insurance premiums is stored in registers, from which reports are generated to extra-budgetary funds and the tax authority. To do this, on the tab Salary and personnel need to open Salary reports:

From section Analysis of contributions to funds:

You can obtain detailed information on taxable amounts by type of accrual and by type of contribution for any period:

For generalized information on accrued contributions and personal income tax, a register is created in 1C 8.3 Accounting Taxes and fees (briefly):

This type of report can be printed on paper monthly:

You can annually print out on paper and verify the accrual amounts for each employee by creating the form recommended by the Pension Fund of Russia Cards for individual accounting of the amounts of accrued remunerations and payments, as well as accrued insurance premiums for the year:

The card for recording insurance premiums in 1C 8.3 Accounting, in which data on accruals is reflected monthly and cumulatively from the beginning of the year, can have the following form:

Recalculation (adjustment) of insurance premiums

Sometimes accountants in the 1C 8.3 Accounting 3.0 database have to recalculate contributions for past periods. To configure automatic recalculation in 1C 8.3, you need to use the tab Salary and personnel choose Recalculation of insurance premiums – Create:

To correct errors for previous months that do not affect the previous reporting period, check the box next to the item Independent additional assessment of contributions to correct errors, having established the month in which the adjustment is reflected and the date (last day of the month).

On the bookmark Income information method Selection select the employee for which additional contributions are calculated, as well as the amount:

If the additional accrual affects the previous reporting period for which it will be necessary to submit an adjustment (updated) report, then you must additionally check the box next to the item Register for a clarifying report for the previous period. After automatic calculation of additional charges, click Swipe and close.

Reflection of contributions and accruals to individuals who are not employees

In the economic activities of an organization, payments may be made to individuals who are not employees of the organization, but from whom contributions are paid (except for NS and PP). For example, under civil law agreements (GPC).

In this case it is necessary Create document Contribution accounting transactions via bookmark Salary and personnel:

At the beginning of the calendar year, the accountant needs to check the insurance premium rates approved for the company by current legislation. It is no secret that with the current level of accounting automation, errors occur only if incorrect information has been entered into the system. Below we will look at how to check the established insurance premium rates in 1C and, if necessary, make adjustments.

Where to look for tariffs in 1C

From January 1, 2017, the Tax Code of the Russian Federation (Part Two) was supplemented with Chapter 34 “Insurance Contributions”, which establishes, in addition to payers and the object of taxation, also the amount of insurance premiums. After checking the tariffs established for your company, you can go directly to the 1C system menu “Directories/Salary Settings/Classifiers/Insurance Premiums”.

In the window that opens you will see the following tabs:

- Insurance contributions, discounts on income;

- Types of income from insurance premiums;

- Limit value of the insurance premium base;

- Tariffs of insurance premiums.

We are interested in the last tab “Insurance premium rates”. Here is a list of types of tariffs established by current legislation. Using the ability to search for a type of tariff, we find an individual tariff for your organization, for example, for an agricultural producer paying the Unified Agricultural Tax.

By double-clicking on the cell with the tariff size, we will see a pop-up window that allows you to edit the size of the established tariffs.

You can sequentially select the period for which the rate applies, the type and size of the rate. Insurance premium rates include contributions to pension, social and medical insurance. For the current year they are set respectively in the following amounts: 22%, 2.9% and 5.1%. If any discrepancies are found, you can easily edit the amount of insurance premiums.

In addition to the specified method, setting up insurance premiums in 1C can also be set through the menu “Administration/Accounting Settings/Salary Settings”. Next we find the already known subsection “Classifiers/Insurance Premiums”.

Setting the amount of insurance premiums is done in the same way as described above.

Setting up a contribution to the Social Insurance Fund from the National Tax Service and occupational diseases

Important! In accordance with Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55, organizations are required to confirm the main type of economic activity for the previous year. To do this, you must submit the following list of documents to the territorial department of the Social Insurance Fund:

- Application for confirmation of the main type of economic activity;

- Certificate confirming the main type of economic activity;

- A copy of the explanatory note to the balance sheet.

You will find the forms for these applications on the official website of the Social Insurance Fund in the section “Information for employers (reporting forms, forms).”

Based on the information provided, the Social Insurance Fund sets the rate of contribution from the National Social Security and occupational diseases for the next financial year.

After receiving the specified certificate, the accountant must go to the “Administration/Accounting Settings/Salary Settings” menu.

At the bottom of the window that opens, find the “Setting up taxes and reports” tab. In the list of lines on the left, the cursor must be placed on the line “Insurance premiums”. The ability to edit insurance premiums against industrial accidents will be activated.

If necessary, clicking on the “Additional contributions” cell opens the opportunity to select a list of positions with individual insurance premium rates. 1C also allows you to enter additional positions yourself.

It is also possible to set up the contribution rate for accidents and occupational diseases in another way, through the menu “Directories/Salary Settings/Salary Accounting Settings” and then through the already known “Taxes and Reports Settings” tab.

Insurance premium rates include coverage for pension insurance, health insurance and social insurance. At the current time, the rate is 30 percent, of which: the Pension Fund of Russia (PFR) is 22 percent, the Compulsory Health Insurance Fund (MHIF) is 5.1 percent, the Social Insurance Fund (FSS) is 2.9 percent. . Deductions are made from payments and other remuneration in favor of employees. Using this article as an example, let's look at which block you can see insurance premium rates in 1C.

Insurance premium rates in 1C

Insurance premium rates in the 1C: Accounting database can be found in two ways:

- Go to the main menu, select the “Directories” section, then the “Salaries and Personnel” block, in it the “Salary Settings” position;

- We go to the main menu, select the “Administration” section, in it the “Program Settings” block and then “Accounting Parameters”.

The window “Parameters for calculating premiums” opens in front of us, go to the tab “Insurance premium rates”. Next, click on the “Find” button, in the first field “Where to look”, select, for example, “Tariff type”, then in the “What to look for” window, the required type in the work, it could be, for example, “Organizations using OSN, except with /x manufacturers".

After this, rows are opened in the tabular section for all periods of the tariff, indicating:

- Period;

- Vida;

- Transcript for all funds.

If you need to clarify what happened in previous periods, then use this search - it is very clear and convenient, since the entire history of insurance premiums is shown on one line.

Contribution rate to the Social Insurance Fund from NS and PZ in 1C

To set the rate for the social insurance fund against accidents and occupational diseases, you need, as described above, to go to the “Salary Setting” section, which can be selected in two ways:

- “Directories” - “Salaries and personnel” - “Salary settings”;

- “Administration” - “Program settings” - “Accounting parameters”.

A window will open with the settings for salary accounting, put in the “Organization” field and click on the “Find” button, select in the “Where to look” field - “Contribution rate to the Social Insurance Fund from taxes and payroll”, and in the “What to look for” field - there will be a tariff, corresponding to what is specified in the notification that you received from the FSS, it is assigned depending on the class of professional risk.

Every year you need to confirm a certificate provided to the Social Insurance Fund about the percentage of revenue for the main types of economic activity of the company, in order to establish a tariff for an accident or occupational disease.

How to change the contribution rate to the Social Insurance Fund from NS and PZ in 1C

By standing on any column of the line of the previous photo, in which the tariff in the Social Insurance Fund from the National Tax Service and the Pension Fund is registered, on the right side of the mouse, double-click to open the “Salary Accounting Settings” window. Go to the “Taxes and contributions from the payroll” tab, move the mouse cursor down and find the position “Contributions from tax and payroll”, indicate the rate and the number from which it begins to operate.

Don’t forget, at the beginning of the year you need to confirm the tariff and track the change; if it changes, promptly change it in the 1C database.