Key rate of the Central Bank of the Russian Federation for February. The key rate of the Central Bank will replace the refinancing rate in the documents. Definition and introduction history

What is the key rate of the Central Bank of the Russian Federation for today in 2018? What is the “key rate” of the Central Bank of the Russian Federation? Where can I see a summary table of the Bank of Russia key rate values? How does a reduction in the key rate affect loans and deposits? What do businessmen and accountants need to know about the key rate? We will answer the main questions and provide a single table with rates.

Key rate value today

The key rate is the interest rate on the main operations of the Bank of Russia to regulate the liquidity of the banking sector. This indicator is considered an indicator of monetary policy. The concept of “key rate” was introduced by the Bank of Russia on September 13, 2013. And from January 1, 2016, the Bank of Russia equated the refinancing rate to the value of the key rate (directive of the Bank of Russia dated December 11, 2015 No. 3894-U). The key rate of the Central Bank of the Russian Federation for today is shown in the table (by year):

| Key rate sizes | ||

| The period from which the rate is set | Key rate (%, per annum) | Base |

| 30.04.2018 | 7,25 | Information from the Bank of Russia 04/27/2018 |

| 26.03.2018 | 7,25 | Information from the Bank of Russia 03/23/2018 |

| 09.02.2017 | 7,5 | Information from the Bank of Russia dated 02/09/2018 |

| 18.12.2017 | 7,75 | Information from the Bank of Russia dated December 15, 2017 |

| October 30, 2017 | 8,25 | Information from the Bank of Russia dated 10/17/2017 |

| September 18, 2017 | 8.5 | Information from the Bank of Russia dated September 15, 2017 |

| from June 19, 2017 | 9 | Information from the Bank of Russia dated June 16, 2017 |

| from May 2, 2017 | 9.25 | Information from the Bank of Russia dated April 28, 2017 |

| from March 27, 2017 | 9.75 | Information from the Bank of Russia dated March 24, 2017 |

| from September 19, 2016 | 10 | Information from the Bank of Russia dated September 16, 2016 |

| from June 14, 2016 | 10.5 | Information from the Bank of Russia dated June 10, 2016 |

| from August 3, 2015 | 11 | Information from the Bank of Russia dated July 31, 2015 |

| from June 16, 2015 | 11.5 | Information from the Bank of Russia dated June 15, 2015 |

| from May 5, 2015 | 12.5 | Information from the Bank of Russia dated April 30, 2015 |

| from March 16, 2015 | 14 | Information from the Bank of Russia dated March 13, 2015 |

| from February 2, 2015 | 15 | Information from the Bank of Russia dated January 30, 2015 |

| from December 16, 2014 | 17 | Information from the Bank of Russia dated December 16, 2014 |

| from December 12, 2014 | 10.5 | Information from the Bank of Russia dated December 11, 2014 |

| from November 5, 2014 | 9.5 | Information from the Bank of Russia |

| from July 28, 2014 | 8 | Information from the Bank of Russia dated July 25, 2014 |

| from April 28, 2014 | 7.5 | Information from the Bank of Russia dated April 25, 2014 |

| from March 3, 2014 | 7 | Information from the Bank of Russia dated 03/03/2014 |

| from September 13, 2013 | 5.5 | Information from the Bank of Russia dated September 13, 2013 |

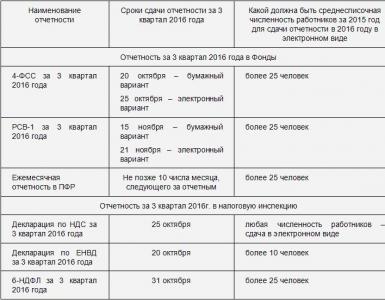

Also on the website of the Central Bank of the Russian Federation you can always find the official key interest rate for today. The information is displayed on the main page of the Central Bank:

Many people quite often come across various news about the key rate on television, radio or on the Internet. So, for example, recently there has been more and more news about the reduction of the key rate of the Central Bank of the Russian Federation? But how should we approach this? Is it good or bad? Many people don’t think about this and believe that the trend towards lowering the key rate does not affect their lives in any way. But is this really so?

If an increase or decrease in the key rate is not so important for ordinary people, then why does the news about the next meeting of the Central Bank of the Russian Federation on the issue of changing the key rate occupy the top lines? We will talk about this further and give examples of the impact of the size of the key rate not only on ordinary citizens, but also on business.

How the Central Bank of the Russian Federation changes the value of the key rate

Only the regulator, the Bank of Russia (Central Bank of the Russian Federation), has the right to increase or decrease the key rate. For these purposes, special meetings are held at which the commission decides on the possibility of adjusting the current key rate. Following the results of such meetings, the Central Bank of the Russian Federation issues press releases about the decisions made, which are published on the website of the Central Bank. The key rate is reduced or raised by “basis points”. Therefore, in official data the abbreviation “bp” is usually used.

Official press releases, as a rule, describe in some detail the prerequisites for making a particular decision on the key refinancing rate. So, for example, in a press release dated September 15, 2017, the Central Bank of the Russian Federation announced a reduction in the key rate by 0.5 percentage points to 8.5%. It is explained that the following factors were taken into account when making this decision:

- inflation dynamics;

- monetary conditions;

- economic activity;

- inflation risks.

On October 27, 2017, the Central Bank continued to reduce the key rate and lowered it to 8.25 percent. The Central Bank noted the continued economic growth and increased inflation expectations. The Central Bank intends to continue to move from moderately tight to neutral monetary policy.

Why do bankers analyze these indicators? How, for example, are economic activity and inflation in a country related to the size of the key rate? This will be discussed further.

The calendar of meetings of the Central Bank of the Russian Federation on the key rate can be found on the Bank of Russia website. It is posted at this link. For example, the next meeting on the rate is expected on October 27, 2017.

Key rate: loans and deposits

The key interest rate is the rate at which the Central Bank can provide loans to commercial banks. Also, at the key rate, the Central Bank is ready to accept money from banks for deposits. Let us explain these questions in more detail.

Late refund of taxes and contributions

If the Federal Tax Service has returned the overpayment of taxes or insurance premiums with a delay, then the tax authorities are obliged to pay interest to the company or individual entrepreneur at the key rate (Article 78 of the Tax Code of the Russian Federation). As a general rule, they must transfer money to the current account within a month after they received an application for the return of the overpayment (clause 6 of Article 78 of the Tax Code of the Russian Federation). But tax authorities may not meet this deadline. Then you need to calculate interest taking into account the key rate using the formula:

Example. The organization filed an application for a refund of overpayment of tax in the amount of 276,000 rubles. However, the tax authorities returned the overpayment 22 days late. The accountant submitted an application to the Federal Tax Service for payment of interest for the delay in tax refund. The amount of interest was 1414 rubles. (276,000 × 8.5% / 365 days × 22 days).

The key rate is one of the most important indicators of the economic state of the country. It is not surprising that the news of its reduction was received positively by banks and entrepreneurs. The last meeting of the Board of Directors of the Bank of Russia was held on December 14, 2018. During the meeting, it was decided to increase the value of the indicator by 0.25% and this is the second increase in a year. This means that currently the key rate of the Central Bank in 2019 is 7.75%. The previous values were in effect from March 23 and February 9 of this year. For the first time since December 2014, the regulator increased the key rate in 2018.

Key bet: concept, meanings

The key rate is understood as the minimum percentage value at which the Central Bank of the Russian Federation is ready to issue a loan to commercial financial institutions with a duration of 7 days. The same concept is used to determine the maximum possible percentage on deposits opened by commercial banks with the Bank of Russia.

From this we can conclude that the key rate directly affects the interest rate on loans issued and deposits issued in all commercial banks in the country.

It is noteworthy that they dropped for the second time in a year to 7.25% from 7.5% a month and a half after the previous decline. Up to 7.75% per annum was changed for the sixth time in 2017 at the end of the year, previously 8.25% per annum was changed for the fifth time in October 2017, 8.5% per annum was adopted on September 15, 2017 and previously 9% on July 16, 2017 year and changed after 2 months, 9.25% per annum adopted on April 28, 2017 and 9.75% per annum adopted by the Central Bank of the Russian Federation on March 24, 2017 lasted about a month, and previously equal to 10%, was valid for more than six months (from September 19, 2016 to March 26 this year).

The Central Bank of the Russian Federation does not rule out that at the next meeting the key rate may be lowered again. But what is the reason for this decision? Why has the key rate changed for the third time this year?

Factors that contributed to the change

The main argument is that inflation is falling faster than expected. There is an increase in economic activity. Even the size of inflation risks went down, while remaining at a fairly high level.

The past decision to reduce the key rate is part of the country's monetary policy. Strict frameworks will help reduce inflation faster. Its planned value at the end of this year is 4%. Analysts miscalculated: they only noted that the Central Bank intends to change the rhetoric towards a potential rate increase, but not to raise it at all.

There are a number of objective reasons that led to the reduction of the Central Bank’s key rate in 2017. But they need to be considered in more detail.

Change in inflation in 2017

As already mentioned, the inflation rate is falling at a faster rate than expected. This conclusion was made in connection with the assessment of the increase in consumer prices. Its meanings are:

- for January – 5%;

- as of March 20 – 4.3%;

- in the third quarter they decreased further;

- In the summer, economic growth remained at 4%.

- Moreover, it is noted that the decline occurred precisely in the first month of spring. In winter, the values were practically unchanged. Although positive dynamics were observed already in February, when the seasonality factor was excluded. The stabilization of the national currency, due to the following factors, also played a positive role:

- foreign investors are also actively investing their own funds in Russian enterprises;

- the price of oil turned out to be higher than expected;

- the size of the insurance premium for the risk has decreased;

- The good yields of previous years allowed agricultural land to make sufficient reserves of products, which made it possible to significantly slow down inflation in this area; as a result, prices for goods in this segment fell.

And yet, the saving model of behavior still prevails in Russian society. There are other positive aspects here: wages increase not only in reality, but also nominally, that is, their purchasing power increases.

The slowdown in inflation should reduce inflation expectations of the population and business representatives. What does this mean? That people will not strive to buy as many goods as possible, but will prefer to open deposits and invest in business.

Changes in monetary policy

The tendency to use a fairly strict credit policy is necessary, if only because it will have a positive impact on the propensity of citizens to save their money rather than spend it due to rising inflation.

It is also planned to reduce interest rates in banks, which will encourage people to take out loans. Although this applies to a greater extent to reliable and solvent borrowers. Otherwise, it is planned to soften lending conditions.

Previously, the Ministry of Finance purchased foreign currency in order to have a positive impact on the ruble exchange rate. True, this did not give a significant result. But inflation risks in the short term were not increased during this operation.

Rapid growth in economic activity of the population

The economic dynamics in the country are gaining more and more positive aspects. Agricultural owners and ordinary entrepreneurs are more determined. There are other factors indicating an increase in economic activity:

- GDP growth;

- increased investment in the Russian economy from foreign citizens;

- increase in industrial production volumes;

- stable unemployment rate;

- an increase in real wages, which increases the demand for goods.

The Central Bank of the Russian Federation also expresses a positive opinion regarding further GDP growth not only in 2017, but also in 2018 and 2019 by an average of 1–2%. And this assessment was made on the basis of a forecast for lower oil prices. It is noted that positive trends will strengthen over time, and timely structural changes should contribute to this.

Inflation risks

There has been an objective reduction in the risk that inflation will not exceed 4% by the end of this year. But there is an assumption that the current value may strengthen for quite a long period of time, which will interfere with the rapid development of the economy, but economic growth is now stable.

Current risks are no longer related to the situation in the country, but to the fact that inflation expectations will not decrease - people, by inertia, will be afraid to save and invest.

Inflationary risks are also fueled by the volatility (changeability) of world markets – goods and money. The country’s monetary policy will allow them to be reduced, and subsequently it will contribute to the reduction and consolidation of inflation.

What to expect next? According to forecasts, the key rate of the Central Bank in 2019 may still change. It’s not for nothing that new meetings are held several times a year. Further, other issues of the country's monetary policy will be considered.

The key rate of the Central Bank of the Russian Federation today is identical to the refinancing rate. These concepts have been combined by the Bank of Russia since 2016 (Instruction No. 3894-U, dated December 11, 2015). The purpose of the key rate is that it denotes the minimum interest level established for loans that the Central Bank issues to commercial financial and credit institutions. Additionally, this indicator fixes the maximum limit on the profitability of deposits that are opened by the Central Bank for banking organizations.

Key rate of the Central Bank of the Russian Federation for today (2018): why is it needed and what does it affect?

For enterprises and individual entrepreneurs, the size of the key rate is important when determining the amount of penalties for late payment of taxes (Article 75 of the Tax Code of the Russian Federation). Tax law sets the penalty for each day in proportion to the refinancing rate. The rule applies to both enterprises of all forms of ownership and areas of activity, as well as individuals. The value of the penalty can be calculated by the tax authority or the business entity itself.

What does the size of the key rate affect:

- with its help, the Central Bank can implement regulatory activities in the financial services market;

- it helps control inflation rates;

- this percentage acts as a starting point in calculating penalties by tax authorities or compensation for late payment of income to hired personnel;

- commercial credit organizations set rates for loan and deposit programs taking into account the current key rate (the interest rate on a loan from a commercial bank always exceeds the rate of the Central Bank of the Russian Federation).

A decrease in the rate provokes an increase in the volume of money in circulation. Following the adjustment in the base rate, commercial banks begin to lower their lending rates. This action may create conditions for increased activity in the domestic consumption market and for the intensification of industrial production. The negative side of this step is increased inflation.

When the key rate increases, credit products become less profitable for both households and businesses. Periods with a high key rate are characterized by a slowdown in economic growth. The positive side is increased interest in deposits.

Key rate of the Central Bank of the Russian Federation in 2018: table

Current data on the key rate can be viewed on the website of the Central Bank of Russia. Since 2016, this indicator has been adjusted only downwards - if in September 2016 it was at the level of 10%, now its value is 7.25%. Changes in rate levels fall within the sphere of influence of the Central Bank of Russia:

- a proposal to increase or decrease the level of the key rate is submitted for discussion to the Board of Directors of the Central Bank of the Russian Federation by convening a special meeting;

- during the meeting, the economic indicators of the development of the country and individual industries are considered, the possible consequences of adjustments are analyzed and a forecast assessment of financial risks is given;

- The outcome of the discussion may be the adoption of the proposed option or a decision to maintain the current limit.

The frequency of meetings is once every 6 weeks. The rate of the Central Bank of the Russian Federation today (2018) is 7.25% (per annum), lower it was recorded only in 2013 - early 2014. The last percentage adjustment occurred on March 26 of this year. The table provides information about what the discount rate of the Central Bank of the Russian Federation is in force today (2018) and how it has changed over time since the date of introduction.

| No. | Bet start date | Interest rate (annual) | Date of the meeting of the Board of Directors and publication of the document fixing the new key rate (information from the Bank of Russia) |

|---|---|---|---|

| 1 | 2013 (from September 13) | 5,5 | 13.09.2013 |

| 2 | 2014 (from March 3) | 7 | 03.03.2014 |

| 3 | 2014 (from April 28) | 7,5 | 25.04.2014 |

| 4 | 2014 (from July 28) | 8 | 25.07.2014 |

| 5 | 2014 (from November 5) | 9,5 | 31.10.2014 |

| 6 | 2014 (from December 12) | 10,5 | 11.12.2014 |

| 7 | 2014 (from December 16) | 17 | 16.12.2014 |

| 8 | 2015 (from February 2) | 15 | 30.01.2015 |

| 9 | 2015 (from March 16) | 14 | 13.03.2015 |

| 10 | 2015 (from May 5) | 12,5 | 30.04.2015 |

| 11 | 2015 (from June 16) | 11,5 | 15.06.2015 |

| 12 | 2015 (from August 3) | 11 | 31.07.2015 |

| 13 | 2016 (from June 14) | 10,5 | 10.06.2016 |

| 14 | 2016 (from September 19) | 10 | 16.09.2016 |

| 15 | 2017 (from March 27) | 9,75 | 24.03.2017 |

| 16 | 2017 (from May 2) | 9,25 | 28.04.2017 |

| 17 | 2017 (from June 19) | 9 | 16.06.2017 |

| 18 | 2017 (from September 18) | 8,5 | 15.09.2017 |

| 19 | 2017 (from October 30) | 8,25 | 27.10.2017 |

| 20 | 2017 (from December 18) | 7,75 | 15.12.2017 |

| 21 | 2018 (from February 12) | 7,5 | 09.02.2018 |

| 22 | 2018 (from March 26) | 7,25 | 23.03.2018 |

| 23 | 2018 (from September 17) | 7,5 | 4.09.2018 |

| 24 | 2018 (from December 17) | 7,75 | 14.12.2018 |

On June 15, 2018, the Board of Directors reviewed the current inflation indicators and other indicators of the economic situation in the country, on the basis of which the (key) rate of the Central Bank of the Russian Federation for today was kept within 7.25%.

Here is an example of how data on the size of the key rate can be useful to an accountant - calculating penalties:

- the company was late in paying taxes in the amount of RUB 122,560;

- the delay period was 5 calendar days.

The percentage of penalties for legal entities is calculated as 1/300 of the key rate on the date of the offense for the first 30 days of delay, from the 31st day 1/150 of the rate is applied (clause 4 of Article 75 of the Tax Code of the Russian Federation). The final calculation will look like:

(122,560 x 7.25% / 300) x 5 = 148.09 rub.

The next meeting of the Bank of Russia on the key rate will take place on December 15, 2017. What should investors expect from the December meeting of the Central Bank of the Russian Federation on monetary policy?

Rate forecasts

According to the consensus forecast, at the meeting on December 15, the Bank of Russia will keep the interest rate unchanged at 8.25%. The Central Bank will need a “breathe” to assess the changing external and internal conditions.

At a meeting on October 27, the regulator lowered the rate by 0.25 basis points from 8.5% to 8.25%. The Central Bank believes that inflation still remains near 4%, and its downward deviation from forecast mainly due to temporary factors. The Bank of Russia also notes the growth of the Russian economy.

True, some economists are optimistic and are preparing for the next decline in December.

Chief Economist for Russia and the CIS at ING Bank Dmitry Polevoy:

The Central Bank of the Russian Federation has changed its previous wording about a possible rate cut in the next two quarters to a statement that "it leaves open the possibility of further rate cuts at its upcoming meetings." Inflation is expected to be around 3% in 2017, up from 3.5-3.8% previously, but still around 4% in 2018, the same as before. The GDP growth forecast has not changed. Overall, the Central Bank remains very cautious, sticking to its forecast for inflation to return to 4% in 2018, despite better-than-expected recent inflation trends

According to ING estimates, the Central Bank of the Russian Federation may reduce the key rate by 25 bps. p. in December 2017 and then by another 100 bp. in 2018 up to 7% per annum.

Chief economist for Russia and the CIS at Renaissance Capital Oleg Kuzmin:

The effect of each decision of the Central Bank on the key rate has a time lag of 6 to 18 months. “Therefore, the decision on the key rate falls into the general treasury of rate reductions against the backdrop of low inflation, which will entail a reduction in lending rates and deposit rates, perhaps later

We think that the Central Bank will end the current monetary policy cycle and move to the promised neutral policy, as he has now promised for the second half of next year, and this will be a rate of 7% or 7.25%, and then the rate there will remain at some long period of time

According to the forecast of Renaissance Capital, the Central Bank of the Russian Federation will lower the key rate in December by 25-50 bp. p. from the current 8.25%, and then by another 100 bp. in 2018.

Is the Central Bank changing its rhetoric?

“Inflation expectations remain elevated. Their decline remains unstable and uneven. Medium-term risks of inflation exceeding the target prevail over the risks of a stable downward deviation of inflation. Taking this into account, the Bank of Russia will continue to move from moderately tight to neutral monetary policy gradually,” the Central Bank emphasizes.

It is important that for the first time in recent years the wording in the commentary has changed - previously the Central Bank constantly spoke about the need to “maintain a moderately tight monetary policy,” but now it intends to “gradually move from a moderately tight monetary policy to a neutral one.” Let us recall that earlier the Bank of Russia called the range of the neutral key rate 6.5-7% (with stable inflation of 4%), the head of the Central Bank Elvira Nabiullina said that it could be achieved in 2019.

When making decisions on the rate, the Bank of Russia will assess the balance of risks of a significant and sustainable deviation of inflation up and down from the target, as well as the dynamics of economic activity relative to the forecast. The Bank of Russia admits the possibility of further reducing the key rate at upcoming meetings.

Based on materials from TASS, Interfax, Finance.ru