Preparing for payroll

![]() Without a doubt this The most comprehensive course on Accounting who I met...

Without a doubt this The most comprehensive course on Accounting who I met...

Particularly interesting for me was the chapter “ Commission trading» and block by fixed asset accounting.

Well helped me pass the exam successfully to Specialist Consultant for “1C: Accounting 8”.

“Without a doubt, this is the most complete course on 1C: Accounting that I have come across, and this applies not only to the implementation of accounting using the software product 1C Accounting 8, edition 3.0, but also to the theory of accounting. The teacher explained in great detail various nuances both from the point of view of accounting theory and from the point of view of its implementation in the program. Of particular interest to me was the chapter “Commission trading” and the unit on accounting for fixed assets.

I really liked the theoretical part of the material. Since I am not an accountant, it was in this area that I had certain gaps in knowledge. This course helped to create a holistic impression of accounting, as seen from the point of view of 1C methodologists.

I believe that at this time, with the abundance of information, it is difficult to find a truly useful course that can expand your knowledge base. In some courses, half of what you already know, in others, there is something that you will never need, but this course was interesting from beginning to end, there was no desire to rewind some sections, even what you already know, you wanted listen, because you are always interested in a competent view of some problem, task or situation. So for me, this course was some kind of systematizing element of somewhat scattered knowledge.

As a non-accountant, this course is very useful for me in practical life, as it allows me to communicate with accounting representatives in a language they understand and even suggest somewhere how to do it better. I got a lot from the course; it helped me in preparing for the exam to become a Consultant Specialist in 1C: Accounting 8.0. I successfully passed this exam.

In general, this is not the first course that I take on the project, and I want to tell you that they were all done at a very high level. Well done!"

Eremina Svetlana Valerievna, Chelyabinsk

Setting up the program, filling out information about the organization and accounting policies

- Reference Information. Preparation of reference books and loading of classifiers (KLADR, OKOF)

- Entering initial balances for fixed assets, cash, mutual settlements

- Setting up the payroll subsystem (plans for types of calculations)

- Accounting for cash transactions of the organization

- Bank operations

- Salary calculation (accruals, alimony deductions, compensation for car use)

- Accounting for fixed assets in 1C

- Accounting for intangible assets and R&D expenses in 1C

- Accounting (receipt and sale) of goods and services

- Production and sales of products in 1C Accounting 3.0

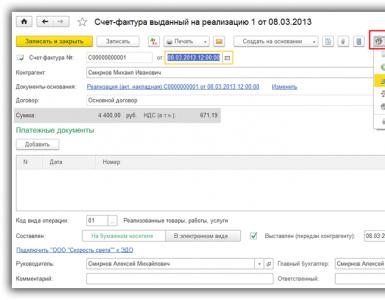

- VAT accounting in 1C

- Calculations for income tax in Accounting 3.0

- Independent work (accounting for organizations according to the simplified tax system)

The product is certified by 1C and can be used both for independent study of the capabilities of 1C Accounting 3.0, and for organizing the educational process at enterprises, professional retraining centers, training centers, educational centers, etc.

Having rights to use 1C:Accounting 8 is not mandatory.

Get started

Select an option to work with the program:

Instructions for installing the program on your computer

1. Install and configure the 1C Accounting 8 program on your computer

If the 1C program is installed on your computer, then you need to:

2. Install V8 tutorial

Download the program installation file by clicking the button:

(if necessary, confirm/allow the ability to download the file)

Run the downloaded file setup.exe

(in case of a danger warning, allow the file to run);

- Follow the installation program instructions.

Important! The program requires an Internet connection to operate.

3. Launch the training program and select the information base

Launch the training program through the “Training site” shortcut on your desktop;

- in the list of information bases, select “Educational enterprise accounting”;

- launch "1C:Enterprise", select a user and click "OK";

You can also expand the methodological support of the free program,

Description

Program features:

Solving practical problems directly in the 1C program;

- checking solutions and providing information about errors;

- availability of personal statistics for solving practical problems;

- ability to view ratings of training participants;

- technical support for users of the training program;

- links and access to methodological materials of the ITS reference database;

- availability of recommendations (tips) for solving practical problems;

- full access to instructions (with pictures) for all tasks to be solved.

Accountants, programmers and 1C consultants who want to independently study and gain practical experience in the 1C Accounting 3.0 program.

Course "1C: Accounting 8". Training in the practical use of the configuration (rev. 3.0) – 32 academic hours + 8 academic hours as a gift!

We invite you to become certified course "1C: Accounting 8". Training in practical use of the configuration (rev. 3.0) at the 1C Training Center "First Bit"!

The course will suit users who have basic knowledge of accounting and tax accounting and plan to use the “1C: Accounting 8” program (rev. 3.0) in future work

During the training process, you will acquire methodological recommendations for the competent organization of accounting in the 1C:Enterprise 8 software, as well as become familiar with the functionality of the program and gain practical skills in working with the 1C:Accounting 8 program (rev. 3.0)

Course "1C: Accounting 8". Training in the practical use of the configuration (rev. 3.0) is:

- The most complete practical course on the program "1C: Accounting 8" - 40 academic hours of practice!

- Certified teaching materials that will stay with you forever

- 1C certificate upon completion of training

+ the opportunity to pass testing for the 1C: Professional certificate for free - Practical teachers are experts with enormous experience

As a result of completing training in the 1C:Accounting 8 program (rev. 3.0), you will be able to:

- Own the configuration tools "1C: Accounting 8" new edition 3.0;

- Make corrections when errors occur in accounting and tax accounting;

- Monitor the status of regulated reporting;

- Practically apply methods of working with documents before preparing accounting and financial statements;

- Confidently work with tables in documents, enter manual entries, set up standard reports - all the functionality of the program will become extremely accessible and understandable to you.

In addition to the standard 32 ac. hour course includes a gift: 8 additional hours of practical work with a teacher!

Course program "1C: Accounting 8". Training in practical use of the configuration (rev. 3.0) – 32 academic hours:

1. STARTING WORK WITH THE PROGRAM. COMPLETING DIRECTORIES

- Starting the program

- Introduction to the configurations "Enterprise Accounting" edition 3.0. Service "Useful information". Reports to the manager

- Setting up accounting parameters

- Functionality

- Accounting policies of organizations subject to the general taxation regime and organizations using the simplified tax system

- Directory "Divisions"

- Basic rules for working with documents and reports of the 1C: Accounting 8 program

- Directories filled in automatically by the program

- Directory "Users". Logbook. Active users. Program settings. Data prohibition date

- Price types and setting item prices

- Warehouses (storage places)

- Nomenclature groups and nomenclature. Item accounting accounts. Directory "Classifier of units of measurement"

- Counterparties. Working with the "Counterparties" directory

- Removal in the program

2. CHART OF ACCOUNTS

3. PREPARATION FOR CALCULATING SALARY

- Directories in labor and wage accounting. Reflection of salary expenses

- Directories "Individuals" and "Employees"

- Salary project

4. REFLECTION OF EXPENSES FOR DEPRECIATION OF FIXED ASSETS. DIRECTORIES "OKOF CLASSIFIER" and "FIXED ASSETS"

5. ENTERING INITIAL BALANCES

- Entering initial balances for fixed assets

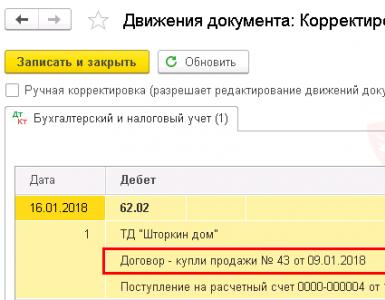

- Entering initial VAT balances for accounts 60.01 and 62.02

- Entering initial balances for accounts 41.01, 51, 80.09, 84.01, 68.01 and 68.04.1

- Transaction log

6. ACCOUNTING FOR CASH OPERATIONS

- Receipt cash order

- Account cash warrant

- Cash Transaction Reports

7. WORKING WITH ACCOUNTABLE PERSONS

- Document "Advance report"

- Travel expenses in tax accounting

- Entertainment expenses

- Balance sheet for account 71

8. BANKING OPERATIONS

- Payment order and payment request as documents for registering non-cash payments

- Details for paying taxes and contributions

- Payment orders for tax transfers. Processing "Payment of taxes and contributions"

- Bank statements

- Purchasing currency. Revaluation of foreign currency

9. CALCULATION OF SALARY. SICK LEAVES

- Documents for payroll accounting. Sick leaves. Payment of wages according to payroll. Salary deposit and payment

- Transfer of wages to the bank.

- Advance payment. Final payroll

- Payroll when applying the simplified tax system

- Payroll reports

10. ACCOUNTING FOR FIXED ASSETS

- Purchase of equipment that does not require installation, but with additional acquisition costs

- Application of bonus depreciation

- Purchase of equipment requiring installation

- Depreciation of fixed assets in accounting and tax accounting

- Accounting for objects with a useful life of more than 12 months and a cost of up to 100,000 rubles. Documents "Transfer of materials into operation", "Decommissioning of materials"

- Modernization of fixed assets

- Group entry of fixed assets of the same name. Temporary differences due to different periods of use in accounting and tax accounting

11. ACCOUNTING FOR INTANGIBLE ASSETS

12. R&D ACCOUNTING

13. ACCOUNTING FOR GOODS AND SERVICES

- Power of attorney. Receipt of goods

- Purchase of goods, with additional acquisition costs

- Third-party company services

- Commission trading. Settlements with the principal

- Returning goods to the supplier

- Import of goods

- Check. Sales of goods and services

- Movement of goods. Inventory of goods in the warehouse. Retail sales. Arrival of surplus

14. SETTLEMENT OF MUTUAL CLAIMS

15. PREFERRED EXPENSES. WRITE OFF EXPENSES OF FUTURE PERIODS

1C: Accounting 8 (Edition 3.0). Level 1: Automated accounting

This course meets the requirements of the professional standard “Accountant”, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated December 22, 2014 No. 1061n!

A unique course specially developed by teachers of the Specialist Training Center with an emphasis on solving real practical problems and authorized by 1C! 1C: Accounting 8 is the most popular program for automating accounting and tax accounting. Today, in more than 90% of vacancies, employers require employees with knowledge of 1C: Accounting 8.

- You will learn all the features of the program,

- In practice, master entering business transactions,

- Learn to prepare standard accounting documents yourself,

- Gain skills in generating standard accounting reports,

- Get acquainted with filling out regulated accounting and tax reporting.

The course is included in the training program for the certification exam. Its price includes a teaching aid that will help you not to miss a single important moment of the lecture and easily remember the material covered.

The course is intended for training accountants and other specialists who want to master 1C: Accounting 8 version 3.0. A lot of time is devoted to the new functionality of edition 3.0, which significantly increases the efficiency of working with the program and expands its capabilities compared to previous versions. Therefore, it will be extremely useful for those who have worked with older versions of 1C: Accounting. New opportunities for working with directories, recording transactions and analyzing data are being considered.

Comfortable classrooms, a workplace with the installed 1C program, professional teachers, coffee breaks, a friendly atmosphere and communication with colleagues will contribute to the effective learning of the material. Training is conducted on the latest versions: 1C:Enterprise platform 8.3 and configuration edition 3.0.

|

Benefits of the course:

|

Setting up accounting parameters in 1C 8.3 is one of the first actions you must take before starting full-time work in the program. The correct operation of your program, the availability of various functionality and accounting rules depend on them.

Starting with version 1C:Accounting 3.0.43.162, the interface for setting up accounting parameters has changed. Also, some parameters began to be configured separately.

Go to the "Administration" menu and select "Accounting Settings".

This settings section consists of six items. Next we will look at each of them. All of them allow you to influence the composition of subaccounts for certain accounts and subaccounts.

Initially, we already have flags set in two items that cannot be edited. You can also additionally enable maintenance by accounting methods.

This setting was also completed. The item “By item” cannot be used, but other settings can be edited if necessary. The list of accounts and subaccounts that are affected by these settings is shown in the figure below.

Here the management of subaccounts 41.12 and 42.02 takes place. By default, only warehouse accounting was installed. It is predefined and we cannot edit it. In addition, this type of accounting can be maintained according to the nomenclature and VAT rates.

Cash flow accounting

This type of accounting will necessarily be carried out according to the account. It is also recommended to additionally take into account in 1C 8.3 the movements of DS according to their items for additional analytics on management accounting.

You can keep records of this type of settlement both for employees as a whole, and for each individual. These settings have a direct impact on subaccounts 70, 76.04 and 97.01.

Cost accounting will necessarily be carried out by item groups. If you need to prepare audited statements in IFRS, it is advisable to also keep records of cost elements and items.

Salary settings

To go to this settings package, you need to follow the hyperlink of the same name in the accounting parameters form. Many of the settings here should be left at default, but you still have a lot of room for action.

General settings

To complete the example, we note that salary and personnel records will be maintained in this program. Of course, there are limitations here, but if your organization does not have many employees, then the functionality of 1C:Accounting will be quite sufficient.

You will see a list of settings for each organization that is accounted for in the program. Let's open the settings for Confetprom LLC.

Here you can indicate how wages will be reflected in the accounting system, the timing of their payment, vacation reserves and any special territorial conditions.

Let's go back and follow another hyperlink.

Among other things, you can also change the way the list of employees is organized in documents and make settings for printed forms.

Allows you to configure lists of types of charges and deductions. Initially, they are already filled with some data.

Also, in this section 1C you can enable the availability of functionality for sick leave, vacations and executive documents. The setting is available only if the database does not contain organizations that employ more than 60 people.

The last setting is very useful, since when editing all its amounts will be recalculated automatically.

This section is necessary to indicate methods for allocating labor costs and mandatory insurance contributions from the payroll to accounting accounts. Initially, these settings are already filled in, but, of course, you can adjust them.

Personnel records and Classifiers

There is no point in describing these last two sections in detail, since everything here is intuitive. Classifiers are already filled in and often leave these settings untouched.

Other settings

Let's go back to the accounting parameters form and briefly consider the remaining settings items.

- Payment terms for suppliers and buyers determine after how many days the buyer’s debt to us will be considered overdue.

- Printing of articles– setting up their presentation in printed forms.

- Filling in prices sales allows you to determine where the price will be inserted into the relevant documents.

- Type of planned prices influences the substitution of prices in documents related to production.

Some of these 1C 8.3 settings were previously made in the accounting parameters. Now they are placed in a separate interface. You can also find it in the “Main” menu.

The setting form is shown in the figure below. Here, going through sections, you can set up income tax, VAT and other data.